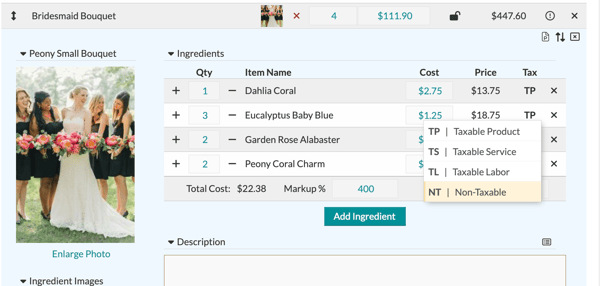

The Worksheet: The Tax Column (TP, TS, TL, NT)

Details Flowers gives you the ability to adjust how you would like your line item charges and fees categorized for your contract.

Before we get started:

The 'T' stands for taxable. If you do not charge tax on products, services, or labor - don't fear! As long as your tax is set up appropriately with a '0' for the category you do not charge tax, it will not add any tax. Ultimately, you are just telling the system how you would like to categorize the charge.

All new line items will always default to a 'TP' - to adjust this, click the 'TP' and select a different option.

What is a TP?

- A 'TP' is a taxable product.

- Most often, you will leave your line items (and ingredients) as a 'TP'.

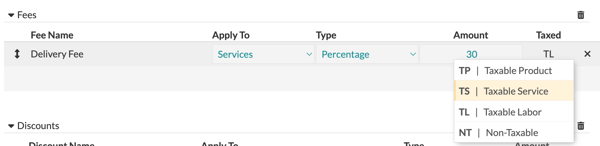

What is a TS?

- A 'TS' is a taxable service.

- Most often, this will be used for groups/line items that you wish to be classified as services - think delivery, setup, and strike.

- All new 'Fees' section rows will automatically default as a 'TS'

What is a TL?

- A 'TL' is taxable labor.

- This can be used to help classify staffing needs - for example, event manager.

- If you use the 'Staff and Labor' section, all items will automatically be classified as labor.

What is a NT?

- An 'NT' is non-taxable product.

- This is particularly helpful if you do not charge tax on certain items, such as rentals. Instead of changing the tax on the whole line item, you will change it on the specific item (the price must be unlocked to do this).

- Remember, if your tax is set for 0 on either services or labor, you can still use a TS or TL. An NT will still be classified as a product!