Company Settings: Tax Settings

Flexible Tax Options for Seamless Event Payments

In your account, you can customize how tax is applied to each event and its associated payments. Whether you prefer to collect the full tax amount in the first payment or the last payment, split it evenly, or apply a different approach for each product, service, or labor, this feature offers complete flexibility!

Setting up Your Tax Settings:

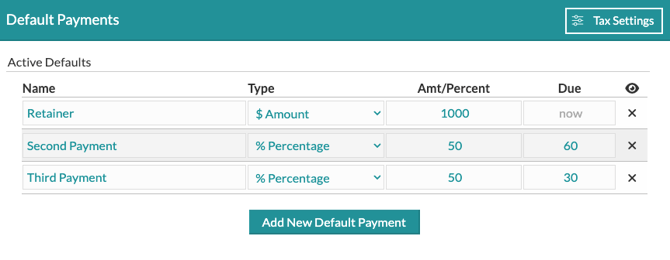

Located in the top right-hand corner of the 'Default Payments' section of your Company Financials page, you will find the 'Tax Settings' button.

Here, you can choose how you would like the tax allocated for your account.

By default, taxes are allocated proportionally, dividing evenly across your payments based on their amounts. If you prefer, you can change this to collect all tax first or last. Additionally, you can set specific tax preferences for each category: Product, Service, and Labor

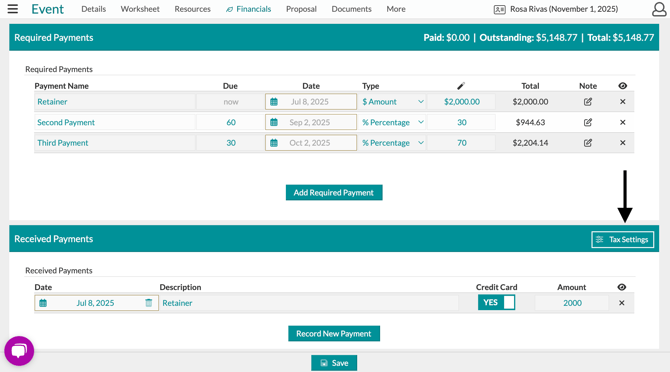

- Navigate to the Event List and select your event

- In the Event Page, click on the ‘Financials’ tab in the top navigation bar

- Select ‘Payments’ from the drop-down menu

- Click on the ‘Tax Settings’ button found in the ‘Received Payments’ section